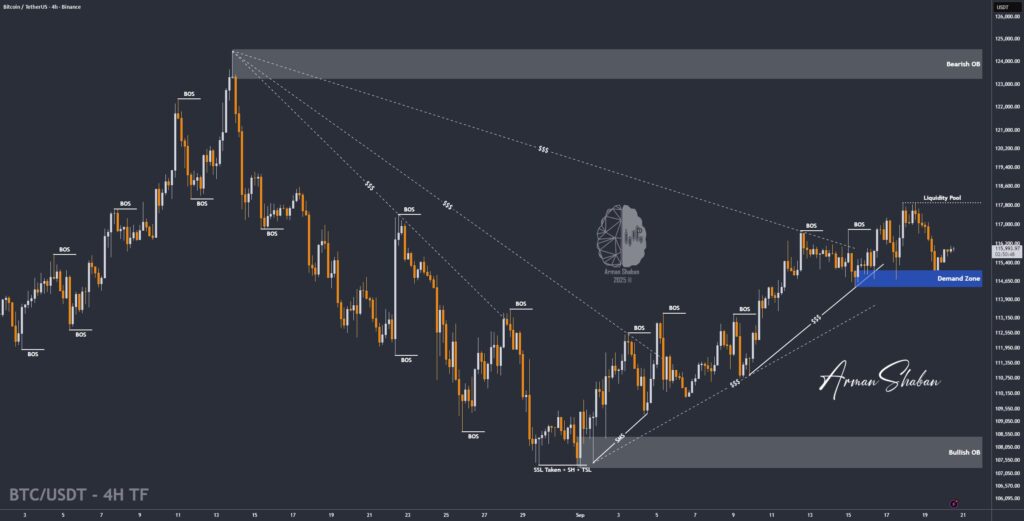

Bitcoin Analysis – 20.Sep.2025

Bitcoin Analysis: By analyzing the Bitcoin chart on the 4-hour timeframe, we can see that the price moved higher as expected, reaching around $118,000. After that, Bitcoin corrected down to the $115,000 demand zone. Once it touched this level, demand stepped in again and the price bounced back. Currently, Bitcoin is trading around $116,000. If the…

Read more