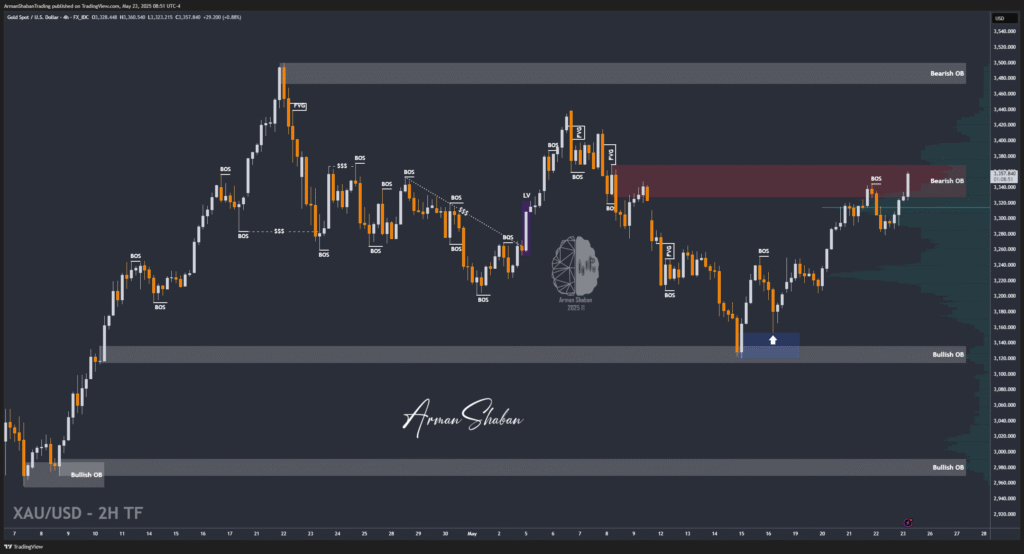

Gold Analysis – 27.May.2025

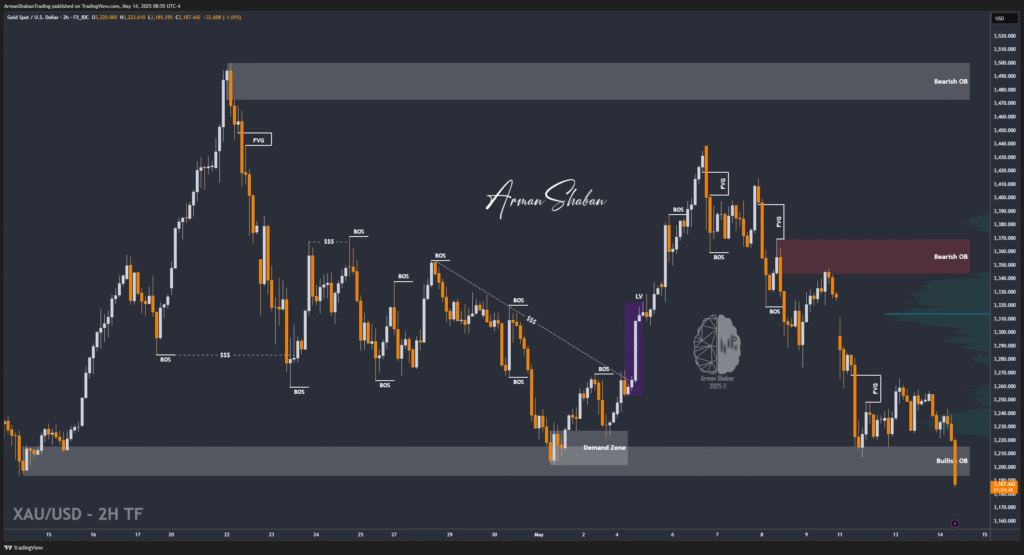

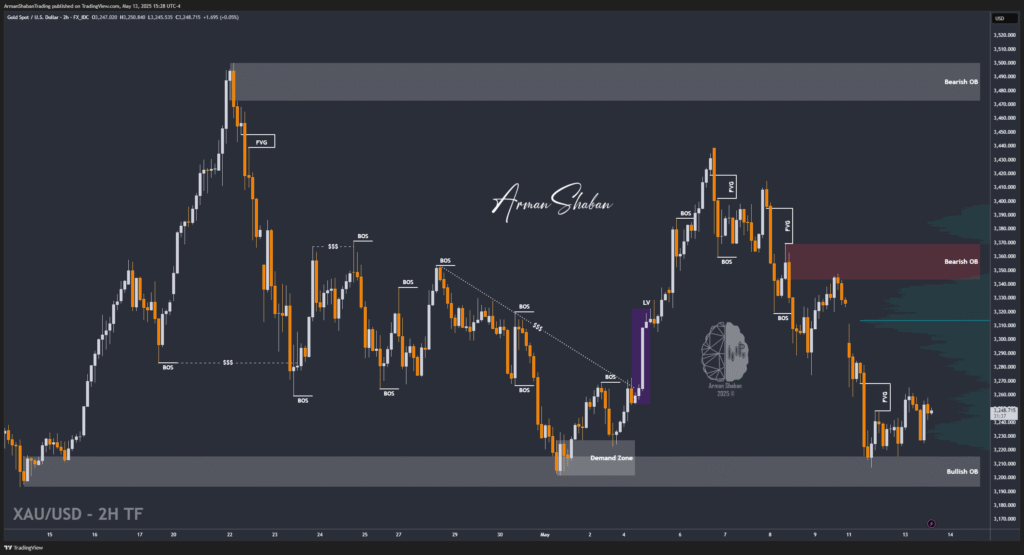

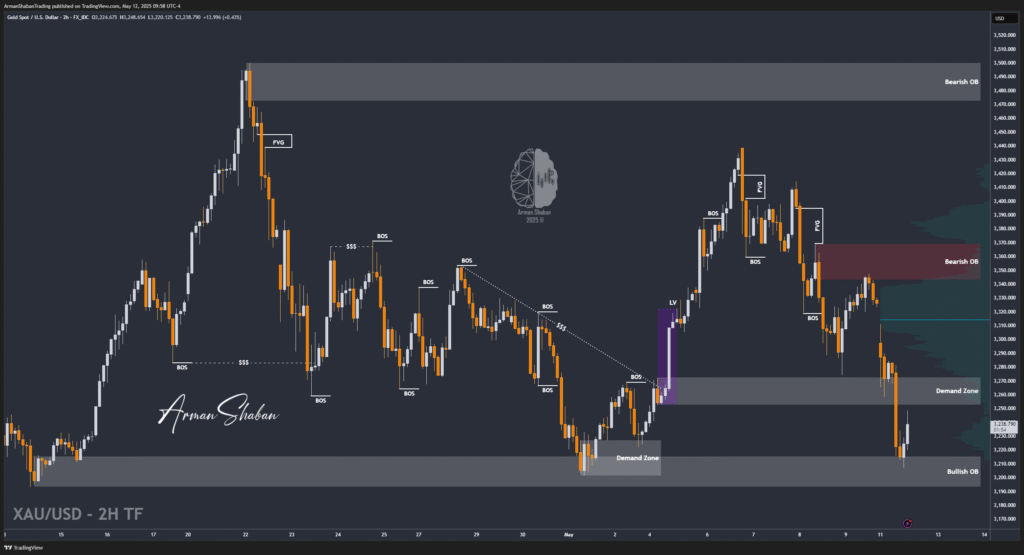

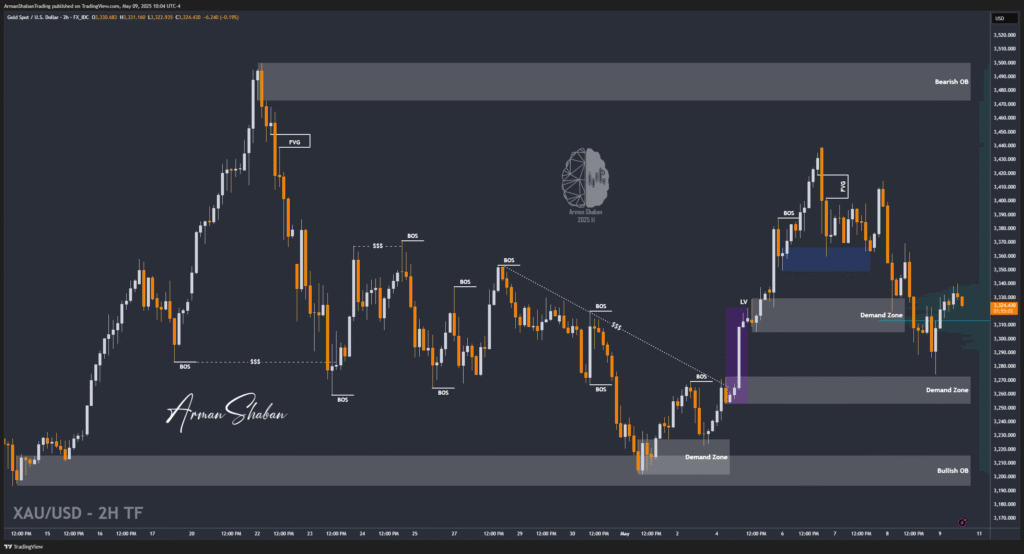

Gold Analysis: By examining the gold chart on the 4-hour timeframe, we can see that yesterday the price managed to rise to $3350 and hit the $3342 target. However, it failed to break above $3350 and started to decline, dropping today as low as $3284. Currently, gold is trading around $3294, and if it fails to…

Read more