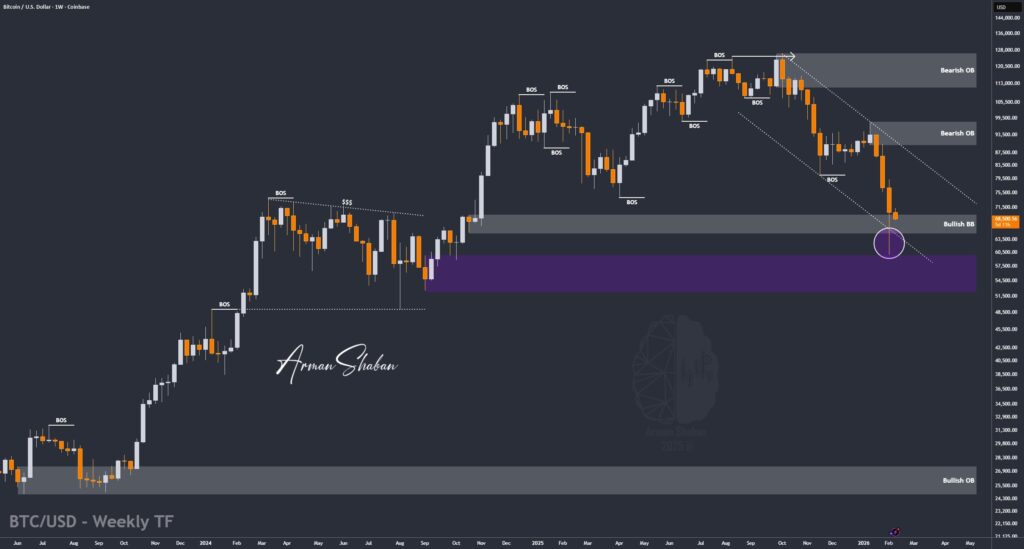

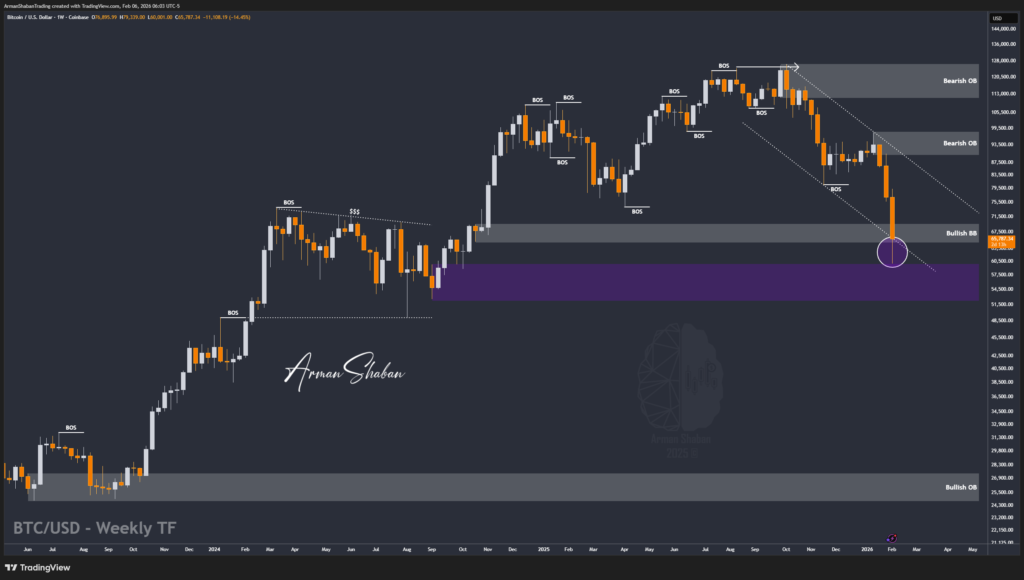

Bitcoin Analysis – 10.Feb.2026

Bitcoin Analysis: By analyzing the #Bitcoin chart on the weekly timeframe, we can see that price continued its bullish expansion and successfully rallied up to the $71,300 level. After this strong move, Bitcoin is currently trading around the $68,500 area, which can be considered a healthy corrective phase within the broader uptrend. All previous assumptions of…

Read more