Gold Analysis – 01.Jul.2025

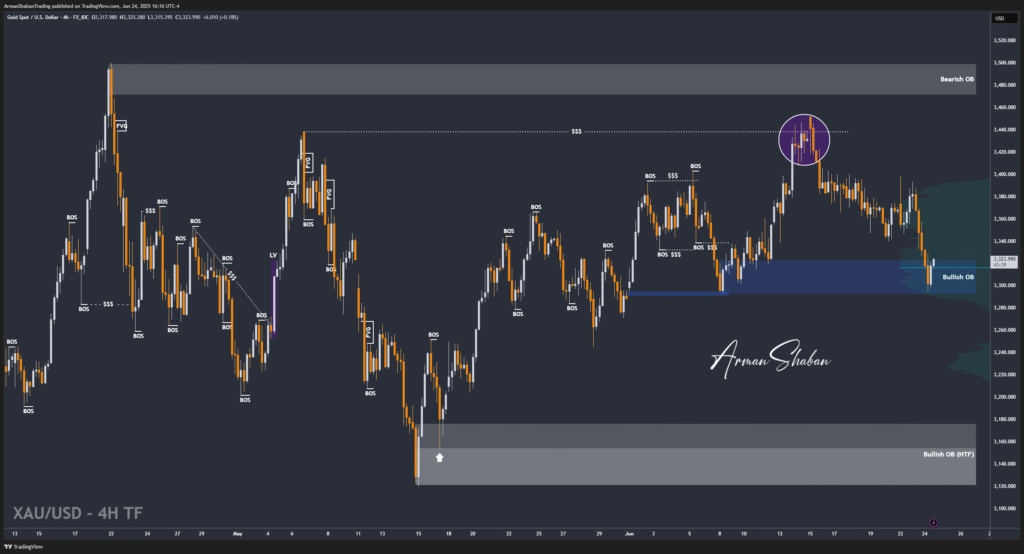

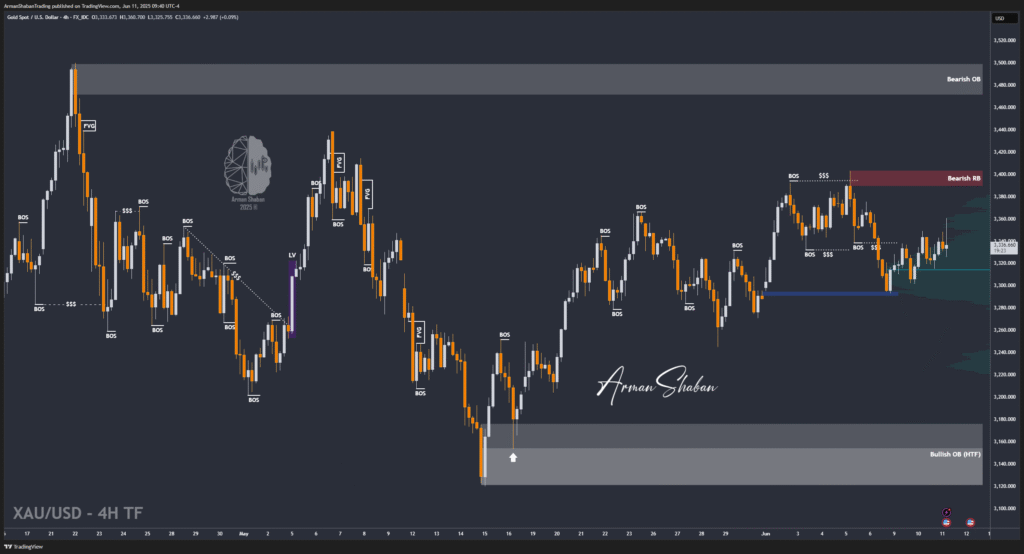

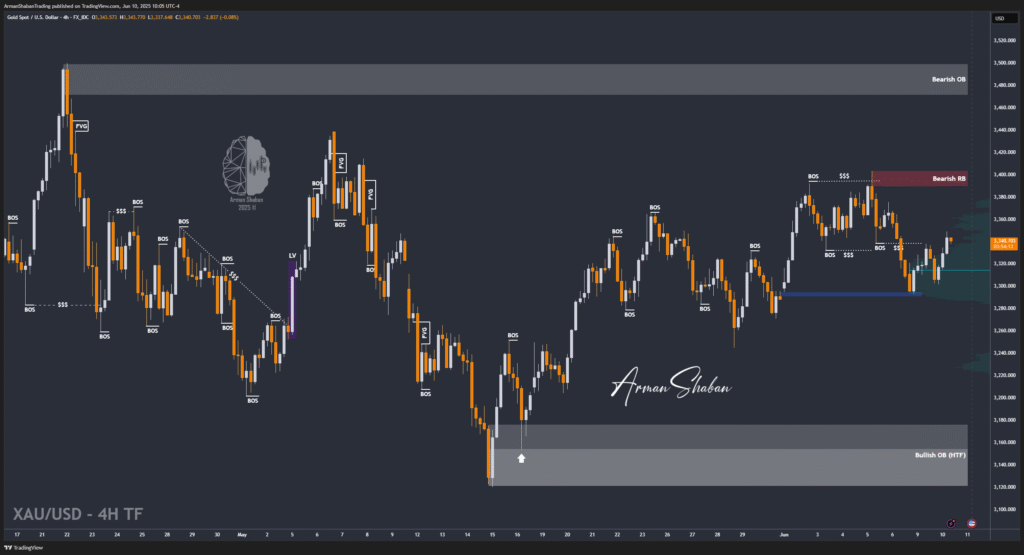

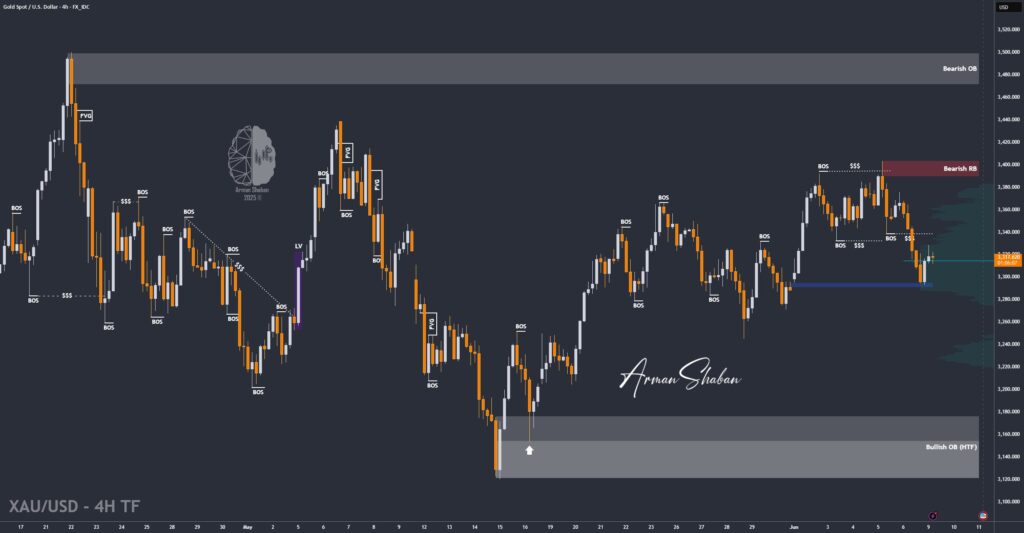

Gold Analysis: By analyzing the gold chart on the 4-hour timeframe, we can see that since yesterday, price moved exactly as expected, hitting all three targets — $3294, $3300, and $3309 — and even extended the rally up to $3358! In the past two days, gold has gained over 1000 pips. As seen now, after sweeping…

Read more