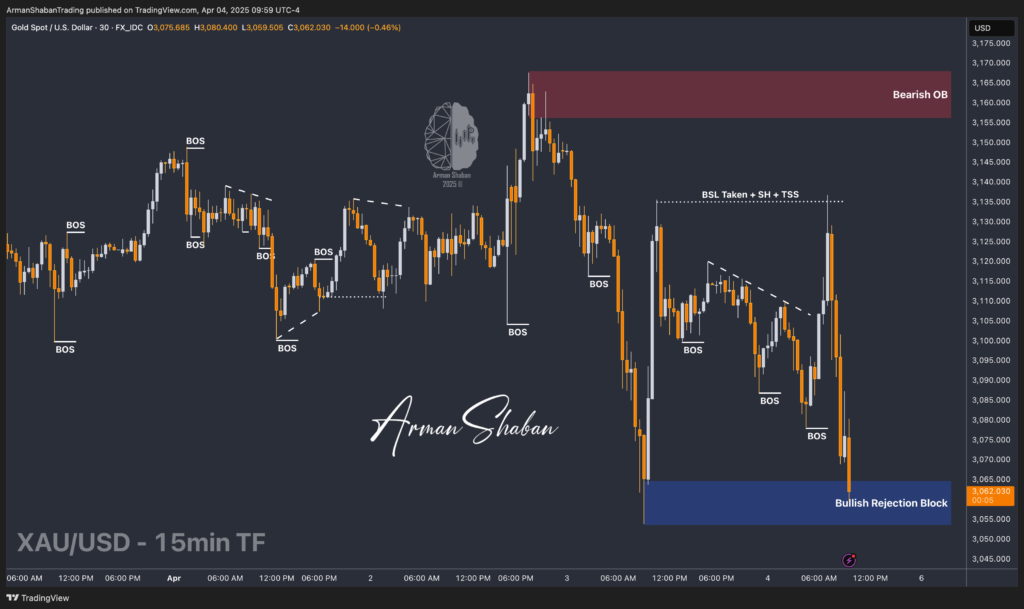

Gold Analysis – 04.Apr.2025

Gold Analysis: By examining the gold chart on the 15-minute timeframe, we can see that after correcting down to $3053, the price was once again met with buying pressure and climbed back up to $3135, breaking above $3100.However, this upward move was not sustained, and after collecting the liquidity above $3135, the price dropped again and…

Read more