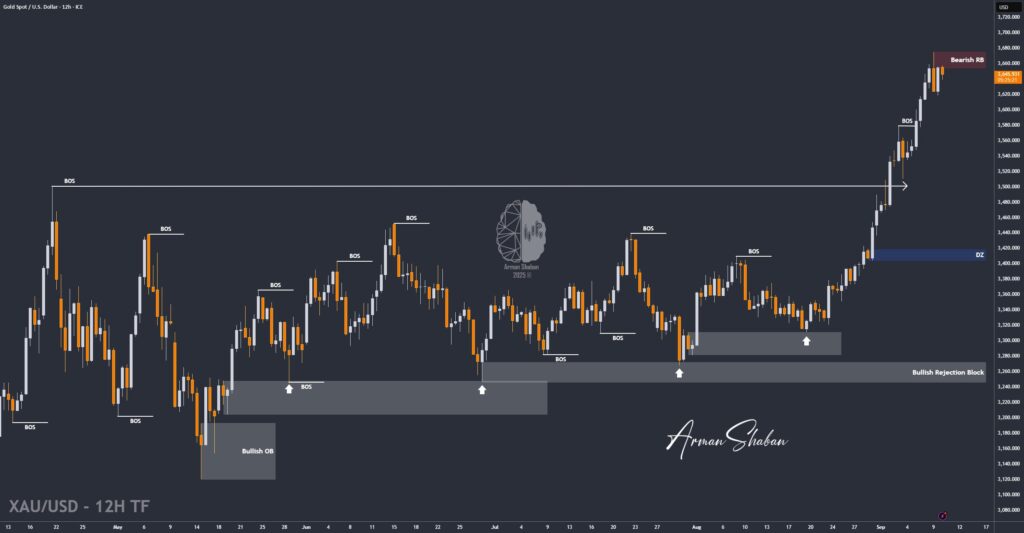

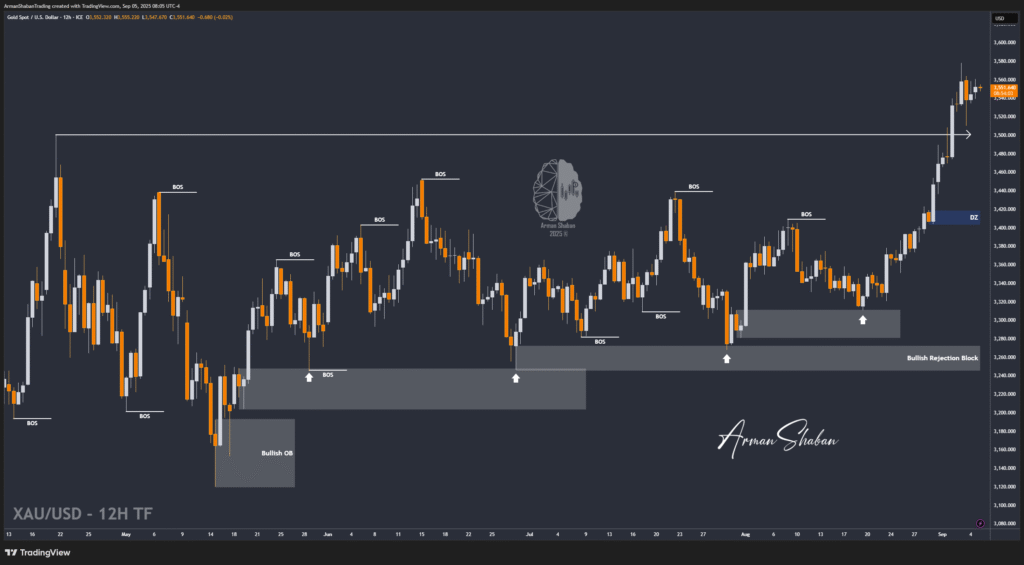

Gold Analysis – 10.Sep.2025

Gold Analysis: By analyzing the gold chart on the 12-hour timeframe, we can see that the price has continued its rally since our last analysis, setting new highs one after another, with the latest peak at $3,675. Currently, gold is trading around $3,644, and we still don’t see any clear change in market structure to suggest…

Read more