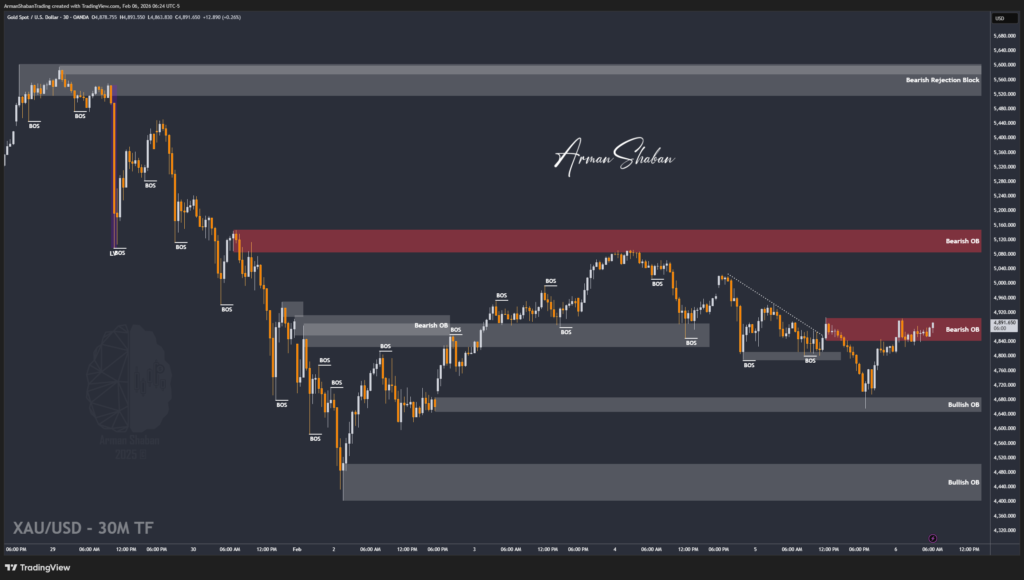

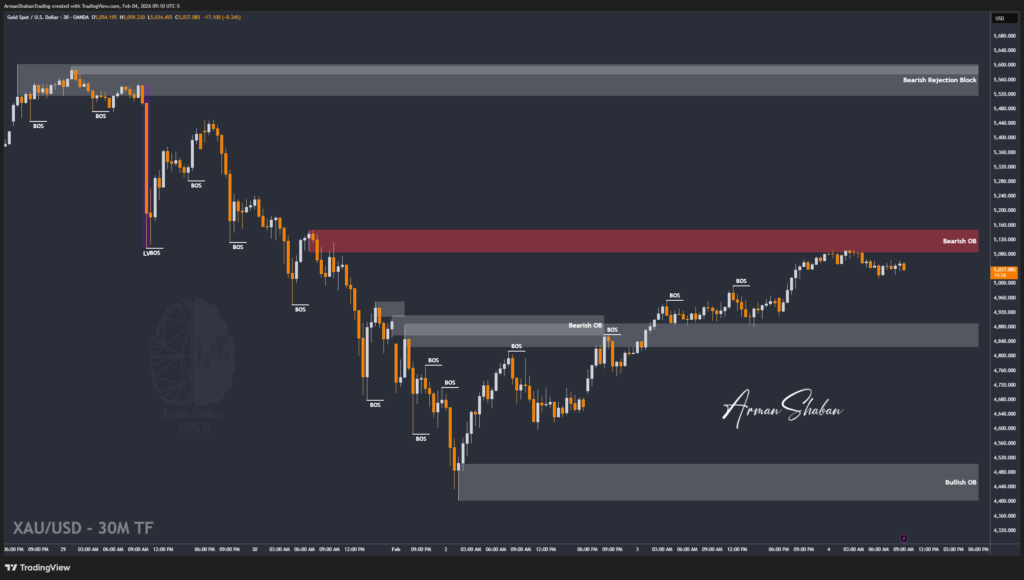

Gold Analysis – 10.Feb.2026

Gold Analysis: By analyzing the #Gold chart on the 1-hour timeframe, we can see that after our last analysis, price first corrected down to $4994 and almost hit the first two bearish targets. After that, gold reversed and pushed higher again, this time rallying above $5080. Once price reached $5086, it faced strong selling pressure and…

Read more