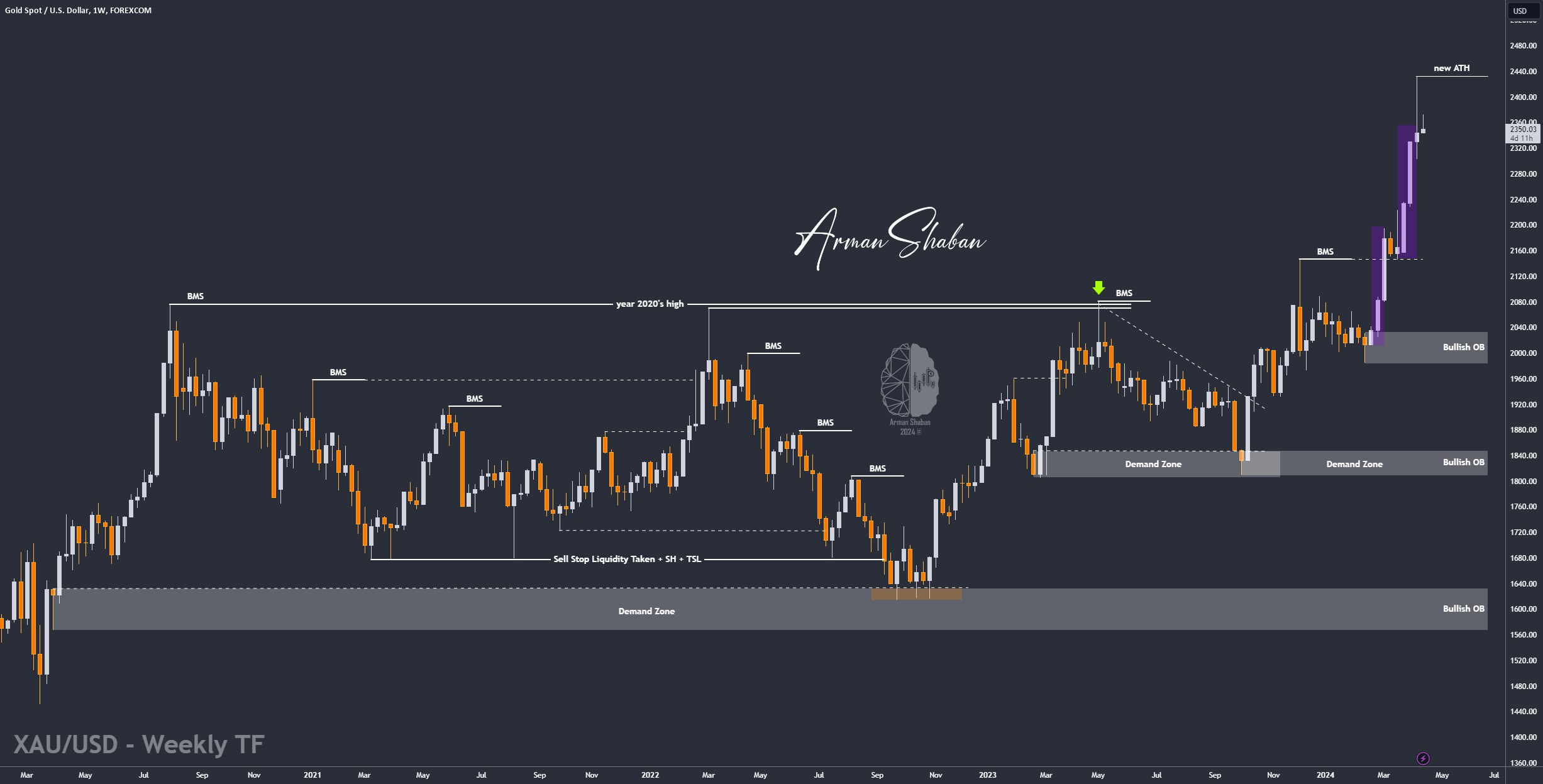

Gold Analysis – 15.Apr.2024

Gold Analysis: Upon examining the gold chart on a weekly basis, it was observed that last Friday marked a significant surge in gold prices. This increase was triggered by the announcement of a potential Iranian attack on Israel, propelling the price to $2431.However, the ascent was short-lived, and the price underwent a sharp decline. In less than four hours, gold experienced a correction exceeding 1000 pips, eventually settling at $2344 by the market’s close. The anticipated attack materialized on Sunday morning, leading to speculations of a price hike when the market reopened. As predicted, Monday saw gold’s value climb from $2344 to $2372. Despite this, the growth was modest, largely because the market had already factored in the news to a considerable degree on Thursday, resulting in diminished tensions. Investors are advised to exercise caution as the specter of war continues to loom over the market. The coming days may witness escalating tensions, potentially driving gold prices higher. It is crucial to monitor the $2404 threshold. Should the price fail to breach this level and instead retreat towards the $2200 channel, with the weekly candle closing within this range, there could be a further downturn in gold prices.

Author : Arman Shaban

To see more analyzes of Gold , Forex Pairs , Cryptocurrencies , Indices and Stocks , be sure to Follow and Join us on other Platforms :

– Public Telegram Channel

– YouTube Channel

– TradingView

– X (Twitter)

– How to join our FOREX VIP Channel ?

– How to join our Crypto VIP Channel ?

– CONTACT ME directly on Telegram