Gold Analysis – 13.Oct.2024

Gold Analysis:

Gold Price Overview:

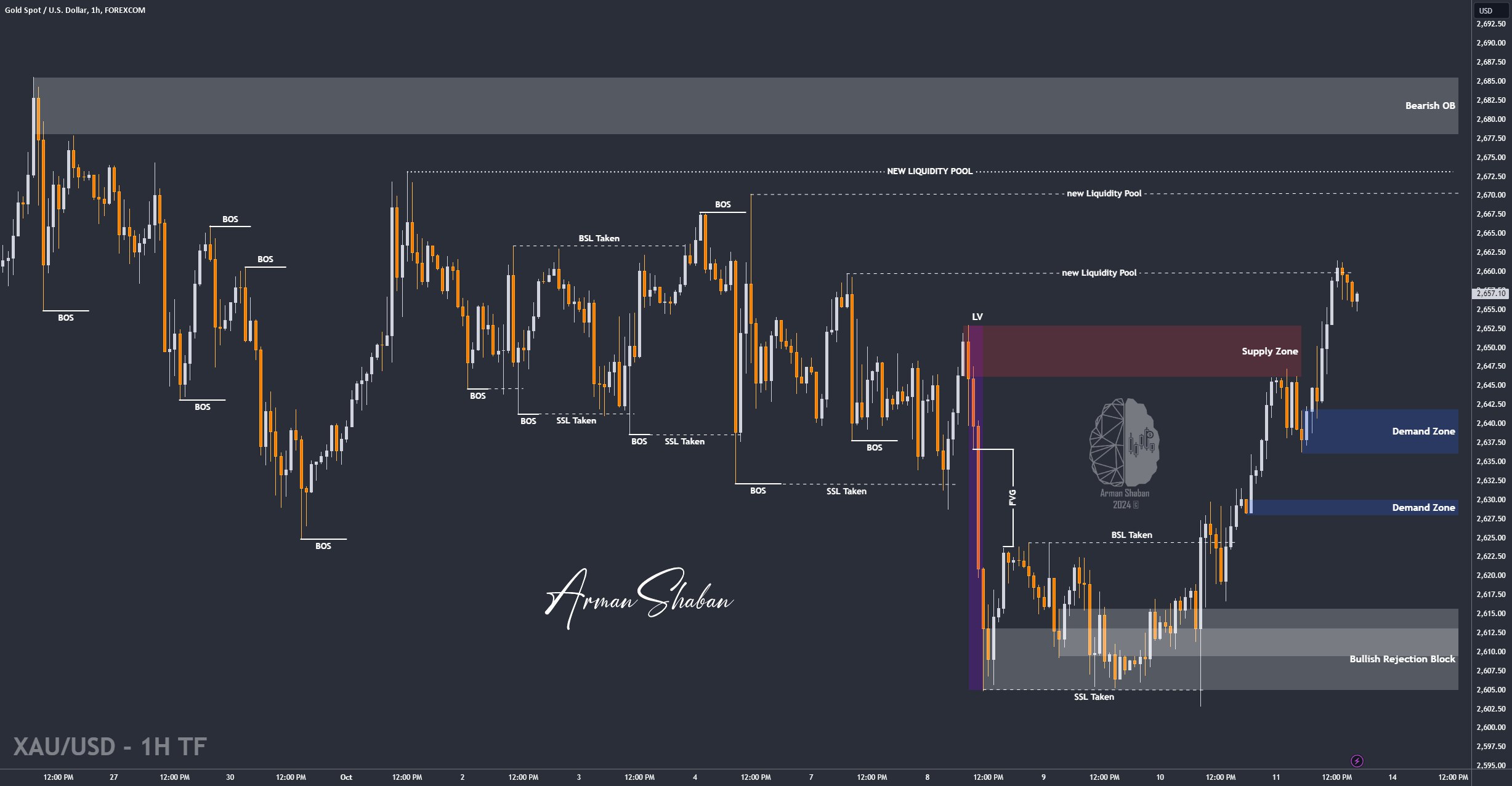

Currently, the price of gold is hovering around $2656.99. Recently, gold has seen a slight increase, driven by several factors such as inflation concerns, recent CPI and PPI reports, and geopolitical tensions.

Key Influencing Factors:

- Persistent Inflation : Recent CPI and PPI reports show that inflation remains slightly above expectations, keeping gold in demand as a safe-haven asset.

- Interest Rates: Expectations around interest rate cuts have stabilized, which increases gold’s appeal as a non-yielding asset.

- Geopolitical Tensions: Ongoing global political instability, particularly in regions like the Middle East, is adding upward pressure to gold prices.

Technical Analysis:

- Resistance Level: If gold prices break above $2685, there could be further bullish momentum.

- Support Levels: On the downside, key support zones include $2636-$2642, $2628-$2630, and $2620, which should be closely monitored if the price declines, as strong demand in these areas could lead to a reversal.

Outlook:

Given the economic and geopolitical landscape, gold remains in a bullish trend. Traders should keep an eye on economic reports and geopolitical developments as any increase in uncertainty could further boost gold’s price.

(This Post on TradingView)

Author : Arman Shaban

To see more analyzes of Gold , Forex Pairs , Cryptocurrencies , Indices and Stocks , be sure to Follow and Join us on other Platforms :

– Public Telegram Channel

– YouTube Channel

– TradingView

– X (Twitter)

– How to join our FOREX VIP Channel ?

– How to join our Crypto VIP Channel ?

– CONTACT ME directly on Telegram