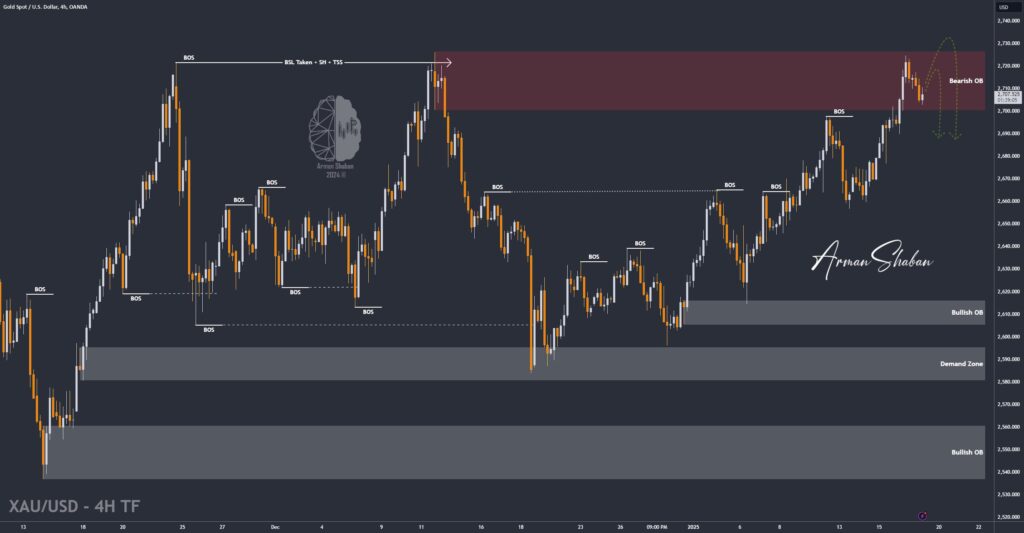

Gold Analysis – 27.Jan.2025

Gold Analysis: Analyzing the gold chart on the 4-hour timeframe, we observe that in the last trading day of the previous week, before attempting to establish a new high, the price faced a correction from the $2786 level and has since declined, reaching as low as $2747. Currently, gold is trading around $2761, and if the…

Read more