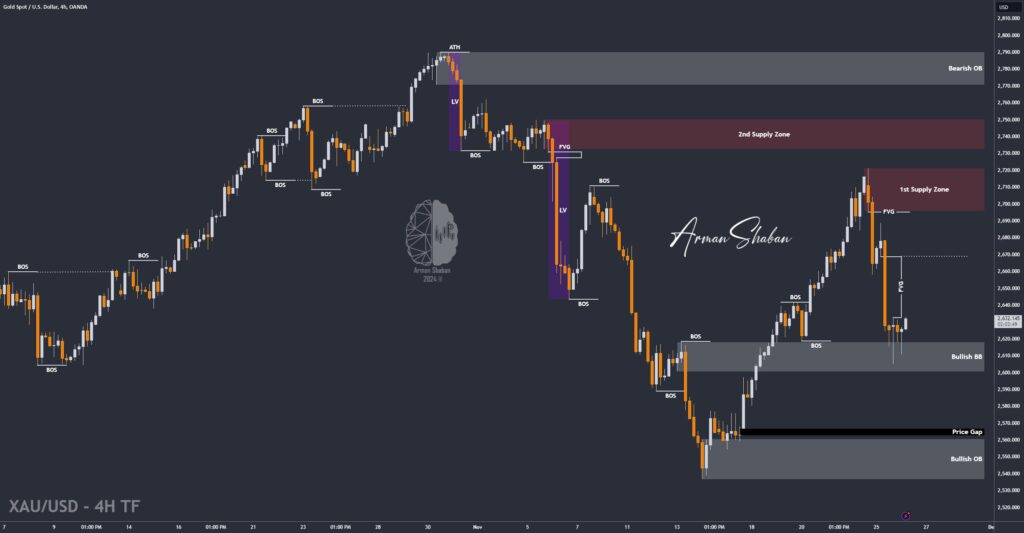

Gold Analysis – 03.Dec.2024

Gold Analysis: Analyzing the gold chart in the 4-hour timeframe, we see that after today’s analysis, the price rose to $2656, followed by a correction. Later, with the release of the JOLTS Job Openings data, gold experienced a further decline, eventually rebounding from the $2635 level. Currently, gold is trading around $2648, with the possibility of…

Read more