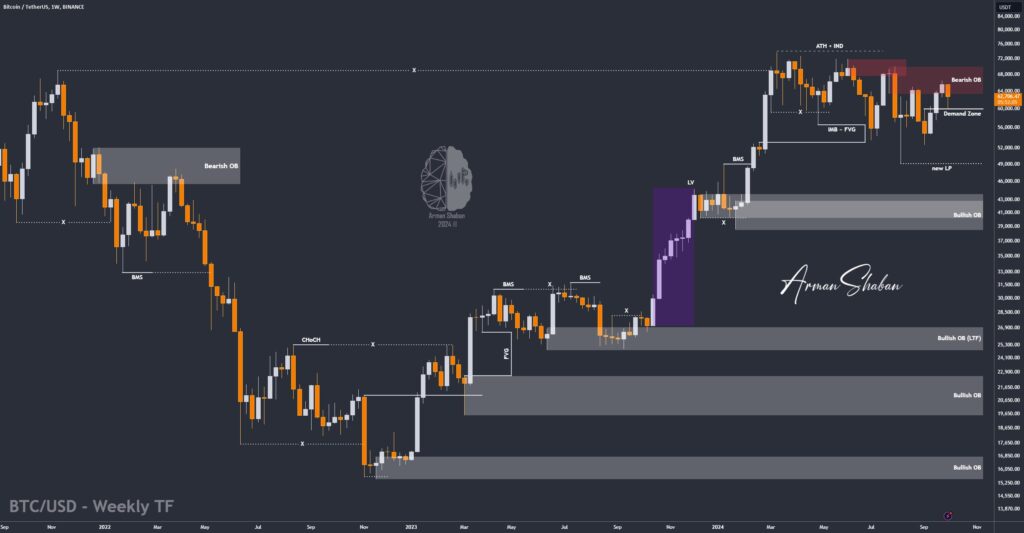

Bitcoin Analysis – 07.Oct.2024

Bitcoin Analysis: By analyzing the #Bitcoin chart on the weekly timeframe, we can see that the current price is around $62,640. We observed that after dropping to $60,000 due to the ongoing conflict between Iran and Israel, the price was met with strong demand and, as mentioned earlier, has rebounded 4% to the current level. If…

Read more