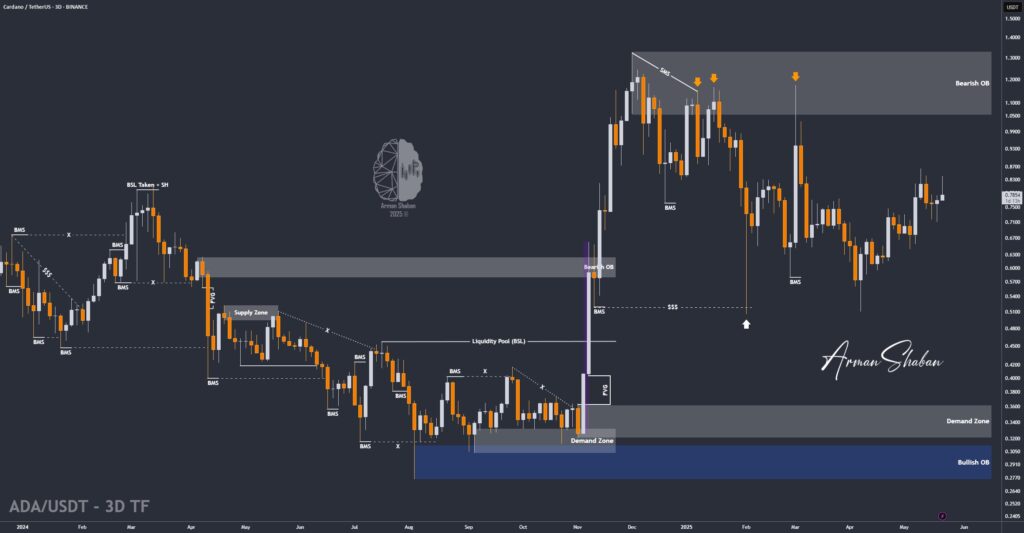

Cardano Analysis – 23.May.2025

Cardano Analysis: By examining the #Cardano chart on the 3-day timeframe, we can see that the price is currently trading around $0.78. If it holds above $0.71, we can expect more upside. The expected return for Cardano is around 30% in the short term, 47% in the medium term, and 85% in the long term.(This Post on TradingView) Author : Arman…

Read more