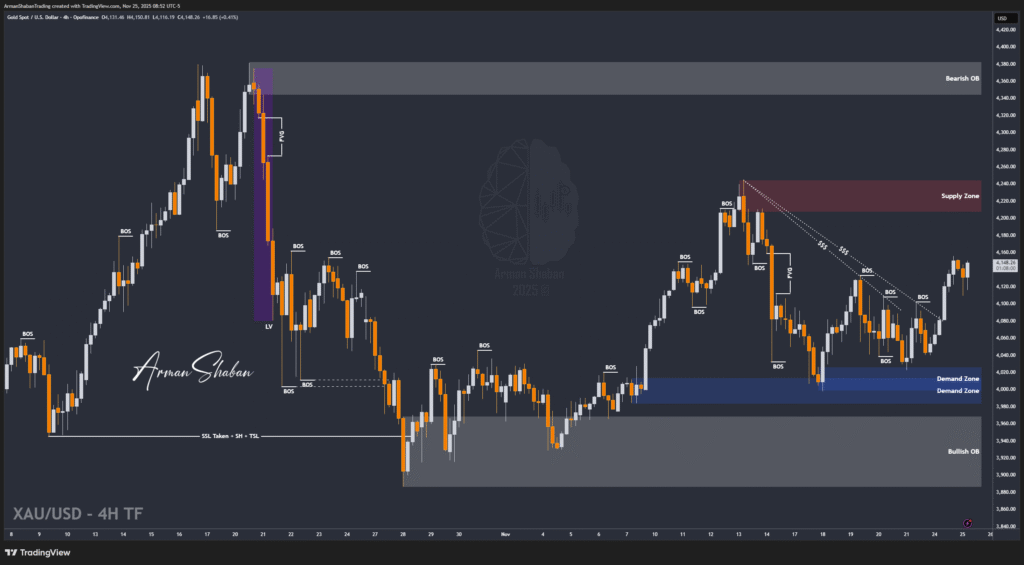

Gold News – 01.Dec.2025

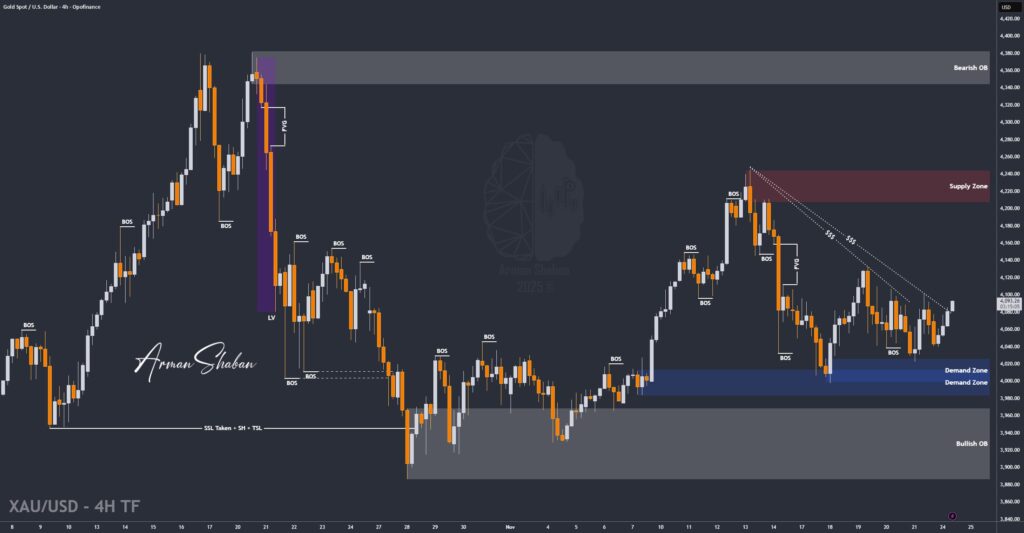

Gold News Key Highlights Gold jumped to around $4,240 per ounce, highest in about 5 weeks. The rally is driven by rising bets on an imminent Federal Reserve rate cut, weakening the dollar and boosting gold’s appeal as a non-yielding asset. A softer dollar, following dovish Fed sentiment and easing yield pressure, adds fuel to…

Read more