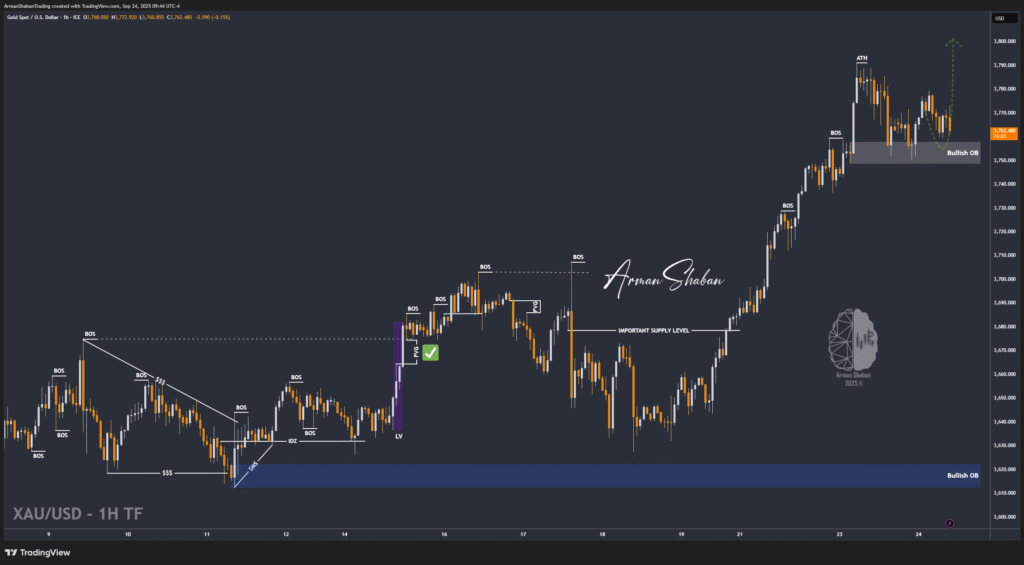

Gold Analysis – 29.Sep.2025

Gold Analysis: By analyzing the gold chart on the 1-hour timeframe, we can see that after reaching the $3,784 supply zone, the price faced selling pressure and corrected down to $3,754. But with the start of the new week, gold continued its rally, hitting a new high at $3,831. As I mentioned in previous analyses, gold…

Read more