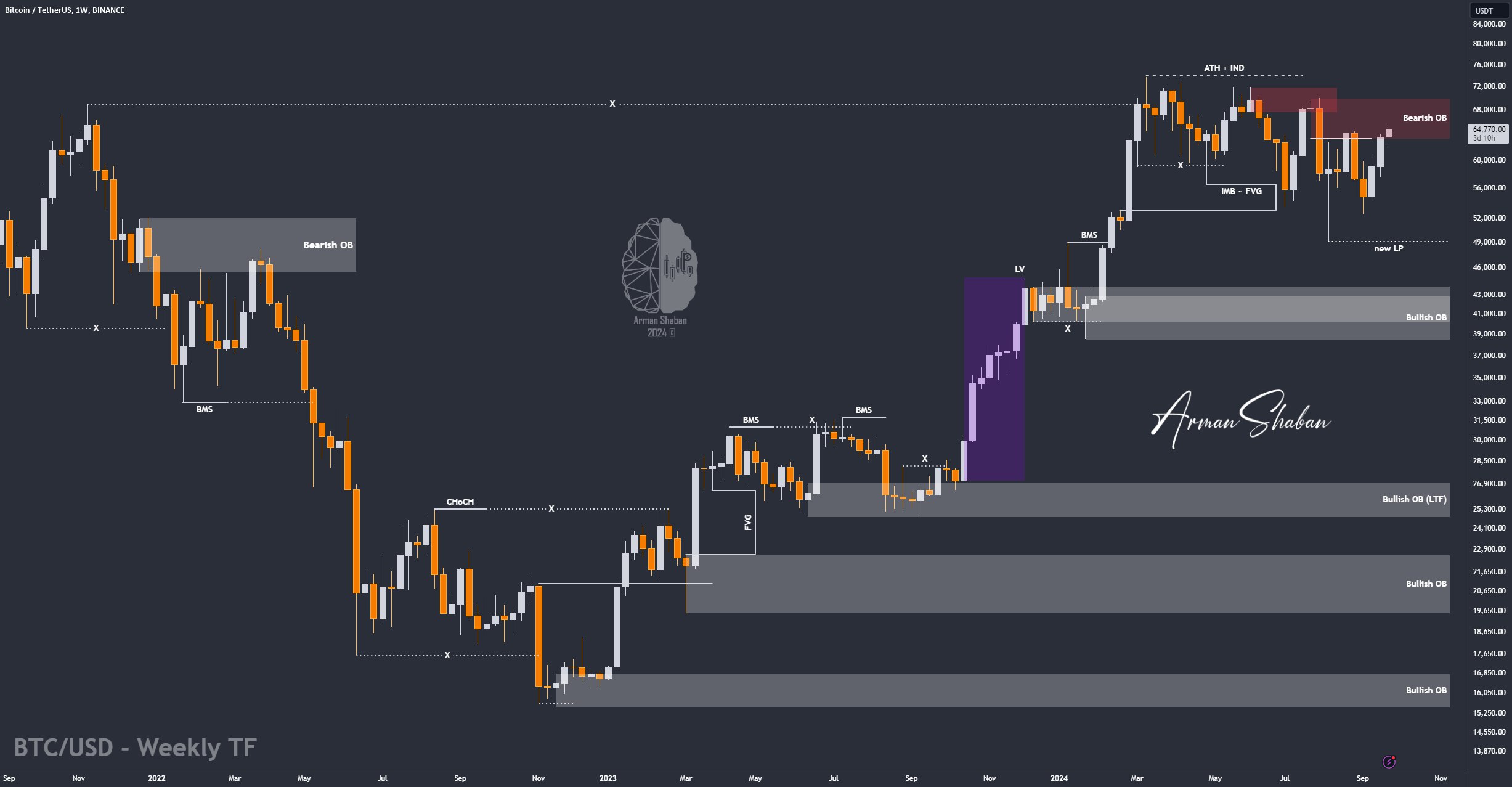

Bitcoin Analysis – 26.Sep.2024

Bitcoin Analysis: Given the recent rise of #Bitcoin in the weekly time frame and reaching $65,000, as expected, strong support was established at $52,750, and the price did not break below $49,000. In this scenario, the short-term targets for Bitcoin are at $67,700 and $71,800. Additionally, based on previous analyses, Bitcoin’s mid-term target is $80,000. With the upcoming release of the Core PCE Price Index (Personal Consumption Expenditures) report tomorrow, it’s important to note that this report directly impacts the Federal Reserve’s monetary policy decisions. If the Core PCE data comes in as expected (0.2%) or even lower, the markets will likely feel less pressure for rapid interest rate hikes. This would benefit riskier assets like Bitcoin, as investors facing controlled inflation and more lenient monetary policies would turn to digital and high-risk assets. In this scenario, Bitcoin is likely to continue its upward trend and reach the short-term targets of $67,700 and $71,800. In the medium term, with easing inflation concerns and stable interest rates, Bitcoin could see further strength, potentially reaching the $80,000 level. However, if the Core PCE data exceeds expectations, indicating higher-than-anticipated inflation, the Federal Reserve may decide to implement more aggressive tightening measures, such as increasing interest rates. This could strengthen the dollar and put short-term pressure on risk assets like Bitcoin. In this case, Bitcoin might experience some downward volatility, with potential support levels at $62,000 and $60,000. However, given the strong fundamental demand and technical factors for Bitcoin, such fluctuations would likely be temporary, and Bitcoin is expected to eventually resume its upward trajectory. The more likely scenario is that Core PCE will come in at or below expectations, providing breathing room for crypto markets and further boosting Bitcoin. However, careful risk management and quick reactions to the data are advised during this critical period.

(This Post on TradingView)

Author : Arman Shaban

To see more analyzes of Gold , Forex Pairs , Cryptocurrencies , Indices and Stocks , be sure to Follow and Join us on other Platforms :

– Public Telegram Channel

– YouTube Channel

– TradingView

– X (Twitter)

– How to join our FOREX VIP Channel ?

– How to join our Crypto VIP Channel ?

– CONTACT ME directly on Telegram