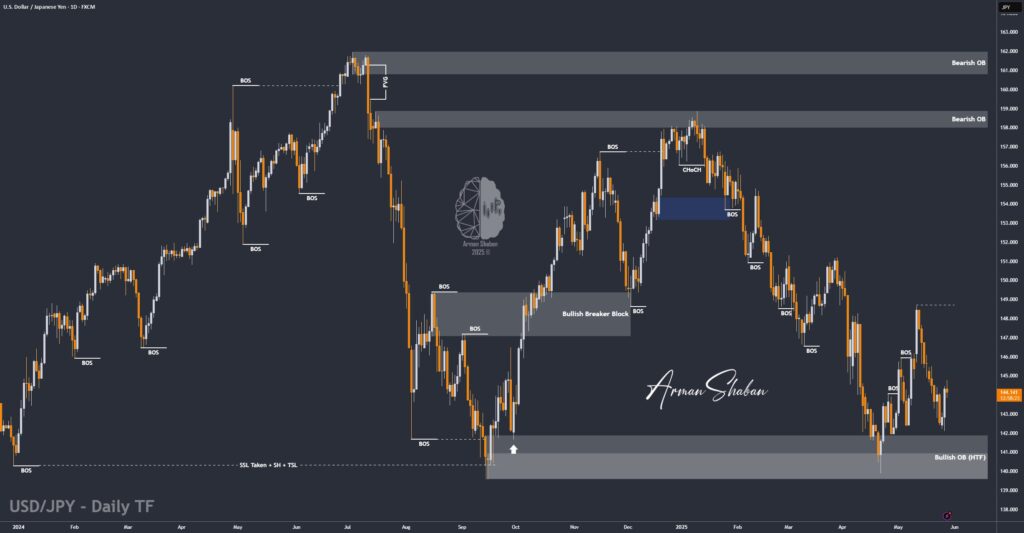

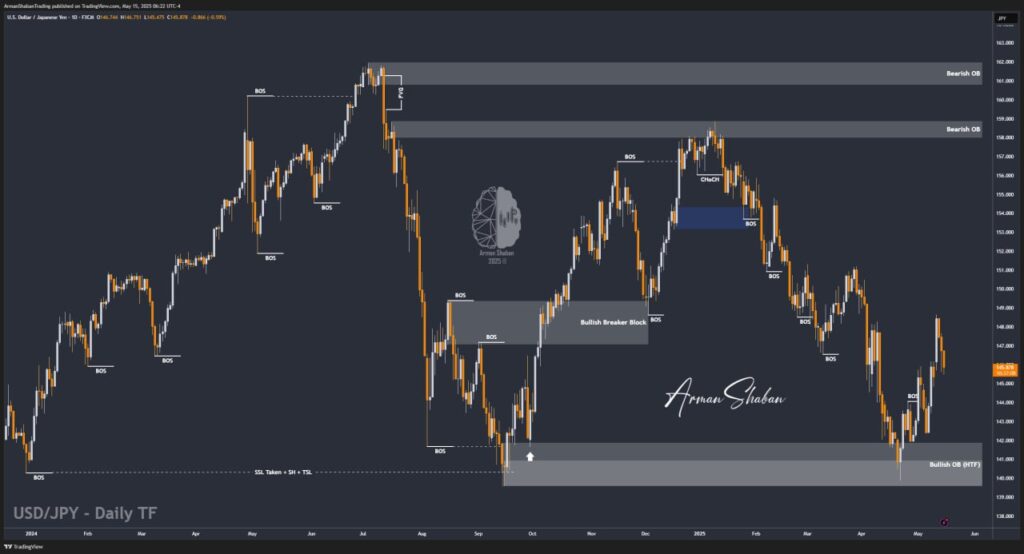

USD/JPY Analysis – 28.May.2025

USD/JPY Analysis : By examining the USD/JPY chart on the daily timeframe, we can see that the price is currently trading around 144. Given the momentum, I expect this pair to rise soon. The potential bullish targets are 145.5, 147.35, and 148.65 respectively.(This Post on TradingView) Author : Arman Shaban To see more analyzes of Gold , Forex…

Read more