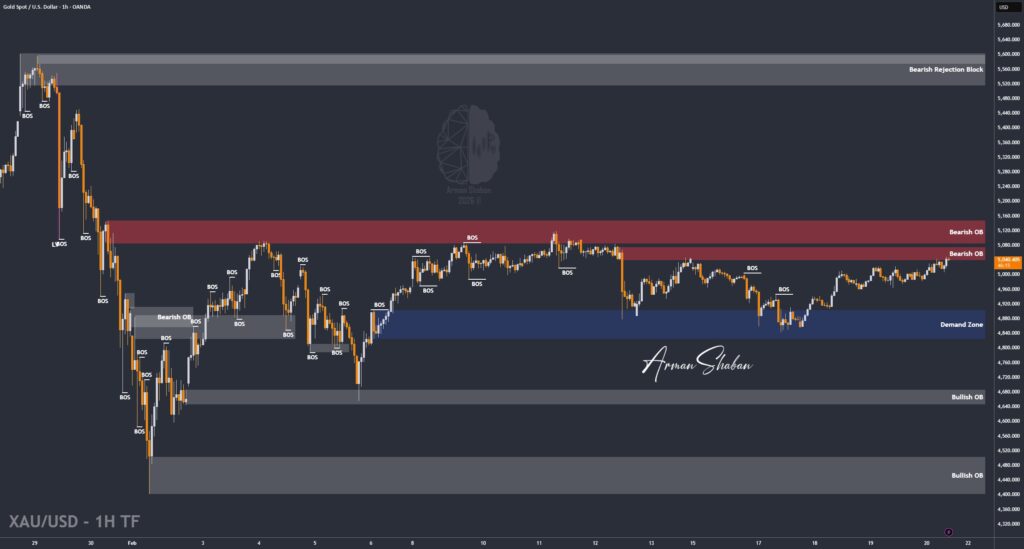

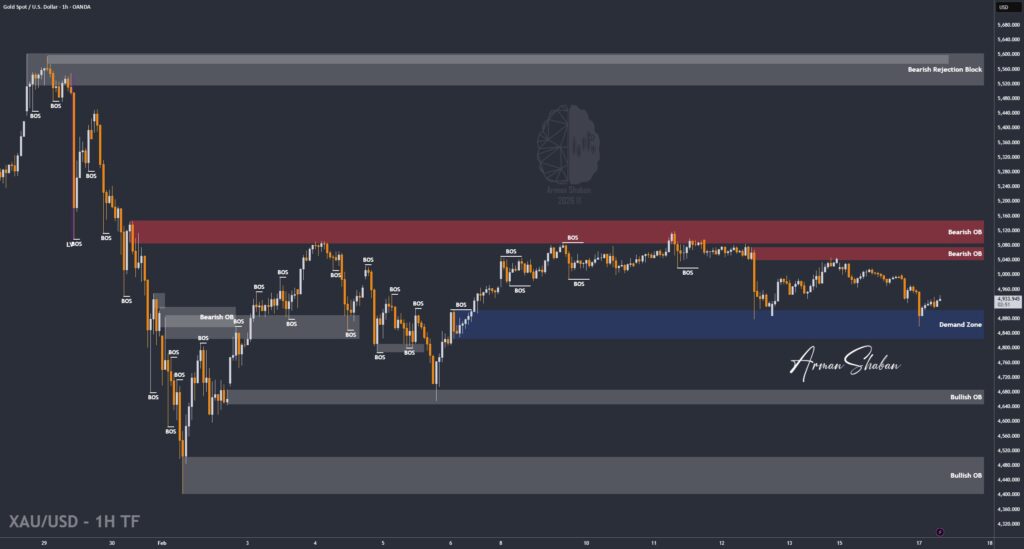

Gold Analysis – 24.Feb.2026

Gold Analysis: By analyzing the #Gold chart on the 2-hour timeframe, we can see that price surged aggressively today and reached the $5250 level, driven by the market reaction to Trump’s 15% tariff announcement. The move was impulsive and expansionary, confirming strong bullish momentum during the session. However, once price entered the OTE region, heavy selling…

Read more