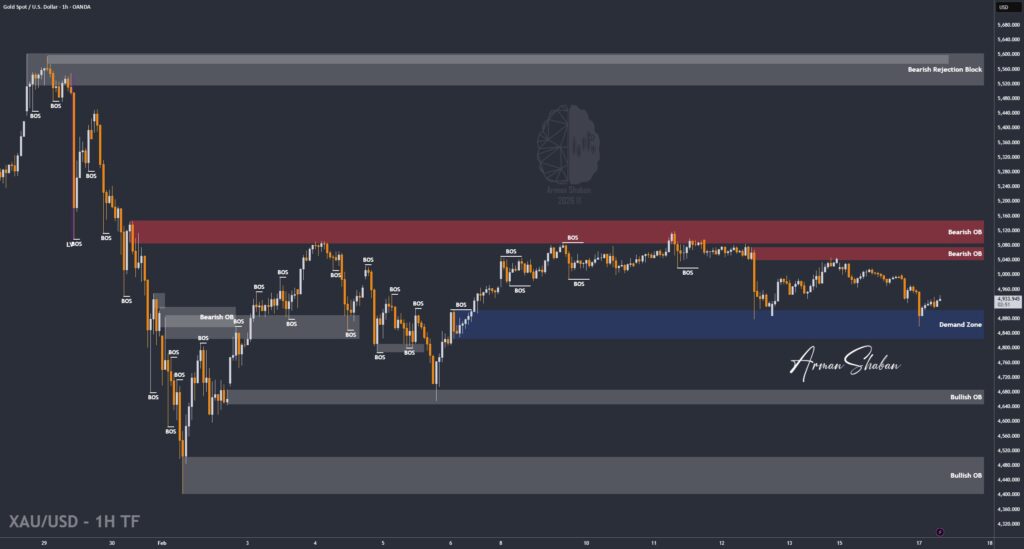

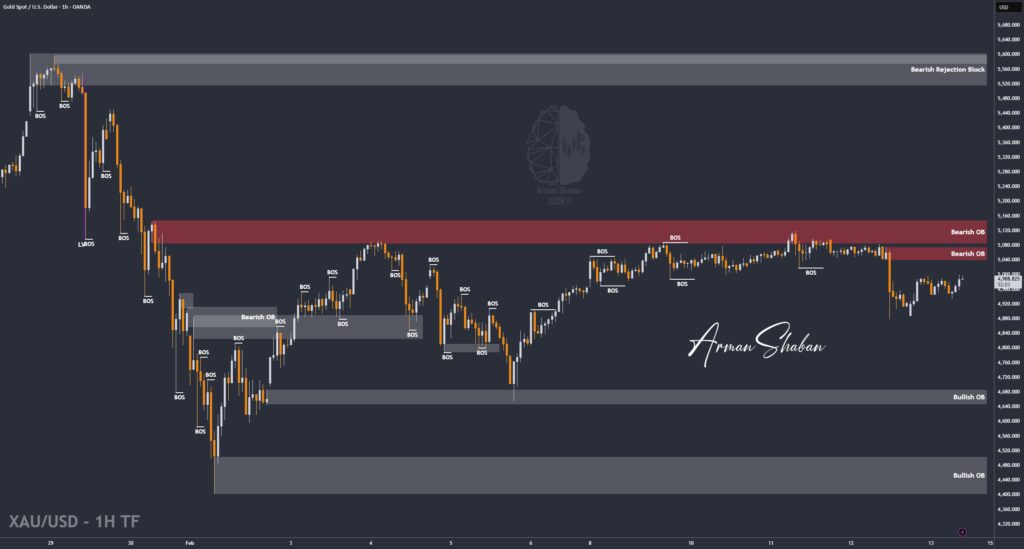

Gold Analysis – 17.Feb.2026

Gold Analysis: By analyzing the #Gold chart on the 1-hour timeframe, we can see that price moved exactly as expected and entered the $5038 to $5077 supply zone. Once Gold reached this area, it faced aggressive selling pressure and experienced a sharp decline down to the $4859 level. After tapping into that demand zone, buyers stepped…

Read more