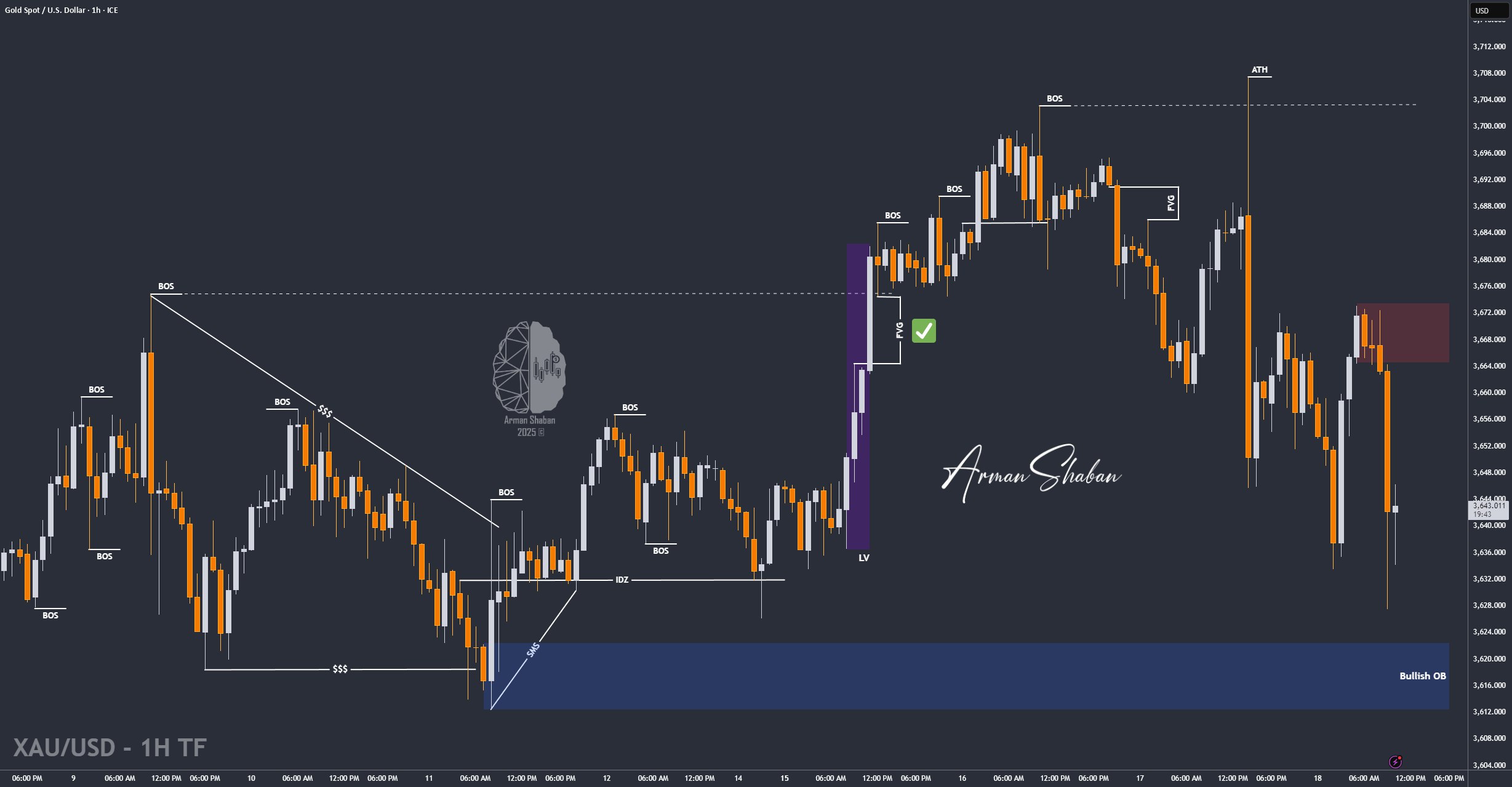

Gold Analysis – 18.Sep.2025

Gold Analysis: By analyzing the gold chart on the 1-hour timeframe, we can see that after the Fed rate cut announcement, the price first dropped from $3,686 to $3,649, stopping out many buyers. Then, gold rallied sharply, gaining 570 pips up to $3,707 and printing a new ATH, which stopped out sellers. After that, the market turned again, with another heavy drop that stopped out fresh buyers too. As I mentioned yesterday, this move was expected. Many asked why gold dropped despite the rate cut — the reason is that the news was already priced in last month. The market had anticipated the cut, which is why gold had already rallied earlier, and that’s why we saw this sharp drop after the announcement. Currently, gold is trading around $3,643 after falling to $3,627. I expect this decline to continue toward the next target zone at $3,612–$3,622. Once price reaches that level, we’ll review the next scenario. The key supply zones to watch are $3,667, $3,677, $3,684, and $3,691.

(This Post on TradingView)

Author : Arman Shaban

To see more analyzes of Gold , Forex Pairs , Cryptocurrencies , Indices and Stocks , be sure to Follow and Join us on other Platforms :

– Public Telegram Channel

– YouTube Channel

– TradingView

– X (Twitter)

– How to join our FOREX VIP Channel ?

– How to join our Crypto VIP Channel ?

– CONTACT ME directly on Telegram