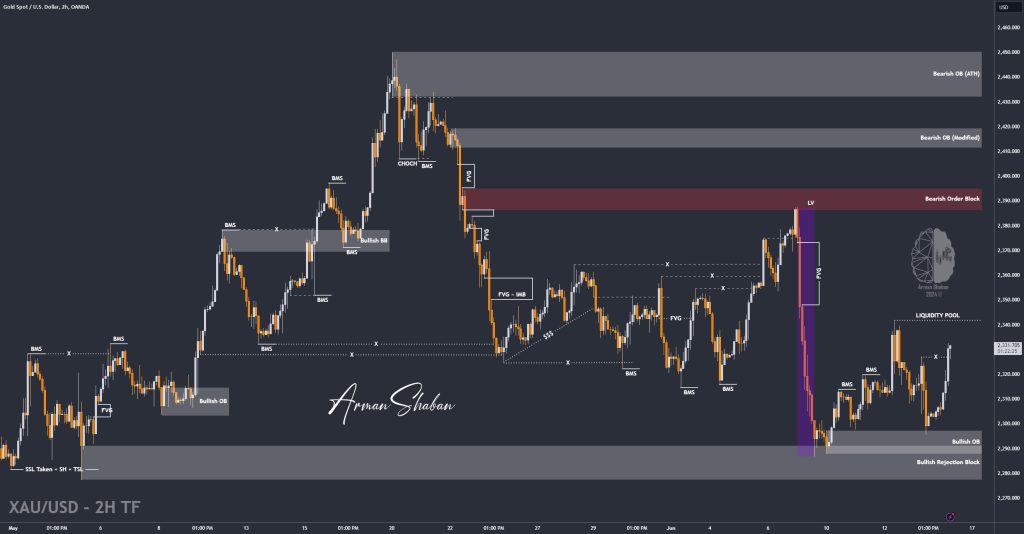

Gold Analysis – 14.Jun.2024

Gold Analysis: By analyzing the #gold chart on the 2-hour timeframe, we observe that after the PPI news was announced yesterday, gold initially experienced a price surge. It climbed to $2327 before encountering selling pressure, leading to a correction of over 320 pips down to $2295. As previously mentioned, the $2295 to $2303 range was a…

Read more